philadelphia wage tax work from home

On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

Work At Home Jobs For Disabled Individuals Work From Home Jobs Working From Home Home Jobs

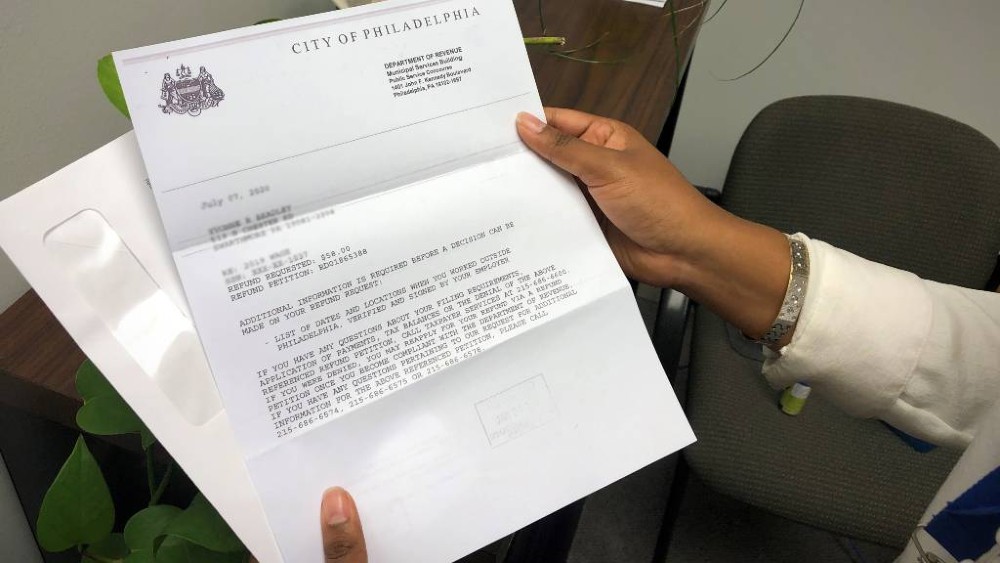

Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online.

. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia. Find Jobs Near Me Employment in Your Area. Ad If Youve Found Yourself On The Job Hunt - We Are Here To Help.

View All Jobs Hiring Now. Taxation of payments received from an employer in exchange for labour or services is subject to the Income Tax Act of 1961 the Act. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Ad Full time part time jobs available. Phillys wage tax is the highest in the nation.

Ad Easy Application Immediate Hire Tax Associate Jobs May Be Available. Easy applications fast hires. Erin Arvedlund tallied up the impact for The Philadelphia Inquirer.

The Department has traditionally employed a convenience of the employer rule under which nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer eg a nonresident employee who works at home one day per week for personal reasons is subject to Wage Tax. Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 35019 of gross wages. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. Heres a step-by-step guide to requesting a city wage tax refund. View All Safe Job Openings Apply Now.

The Department has traditionally employed a convenience of the employer rule under which nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer eg a nonresident employee who works at home one day per week for personal reasons is subject to Wage Tax. But if companies close Philadelphia offices or downsize and require workers to rotate in on assigned days nonresidents will not pay the wage tax when working remotely. If you live outside the city and have been working from home because your company closed its Philadelphia offices under orders from Mayor Jim Kenney and Gov.

The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken. The online forms for a city wage tax refund went live at the end of January. A resident is never exempt from the Wage Tax and is subject to the tax on his or her entire worldwide income.

Search for Tax Associate Jobs Today. Tax Associate Jobs Go Quickly. Tom Wolf you do not have to keep paying the city wage tax.

Do you still work for a Philadelphia company from your home outside the city. The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this. Therefore a non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization.

Ad Find Great Jobs In Your Area On iHireAccounting. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city.

Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office. If companies allow employees to telecommute after pandemic restrictions are lifted workers must pay the wage tax regardless of whether they work from home or not. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. Philadelphia city has launched a new online Philadelphia Tax Center which makes it easier to pay wage taxes but also to apply for a refund if you still work from your home outside the city.

For those who in the past commuted to Philadelphia there is yet another benefit to working from home beyond saving time gas and tolls. Heres everything you need to know about it. Normally Philadelphia non-residents employed in the city can get a wage tax.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the. A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

Online forms went live on Thursday and the paper. As of last year non-Philadelphia residents could apply online to request a refund of the wage tax if the worker lived outside Philadelphia non.

Sample Invitation Letter For Us Visitor Visa Sample Of Invitation Letter Lettering Letter Writing Format

Dd215 Form Online Names Sheet Music Form

The Number Of States Where A Minimum Wage Worker Can Afford A 2 Br Apartment Zero Minimum Wage Wage Work Week

Do You Work From Home In Bucks Or Montco For Your Philadelphia Based Job You May Be Due A City Wage Tax Refund

Delco Map Of Delaware Delaware County Lansdowne

Usa Gasoline Tax Map Map Best Airfare Deals Airfare Deals

10 Cities To Consider For Your Move Infographic Best Places To Live Places To Travel Places To Go

Invest In The Future With Megatrends Ishares Blackrock Ishares Investing Investment Portfolio

What Is Tax Loss Harvesting And How Does It Work Centsai Tax Time Capital Gains Tax Tax

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Consultant Independent Contractor Agreements Ebook Independent Contractor Agreement Independent Contractor Small Business Opportunities

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

This Map Shows The Hourly Wage You Need To Afford A 2 Bedroom Apartment In Your State Low Income Housing Minimum Wage Map

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed Org Word Free Templates Word Template

Subway Job Application Form In Pdf Job Hunter Database Job Application Form Printable Job Applications Job Application

Free Paycheck Stub Template Check On Top Format Payroll Check Printed By Ezpaycheck Payroll Payroll Checks Payroll Software Payroll Template